This is how you can make the ideas in this book effective for use in today’s environment. I use the concept, but not the exact strategy.

I work with it in many different ways, but never calculate and use it exactly as J. It is unlikely that you will be able to profitably trade today’s markets by exactly copying strategies from a book like this, but if you study these strategies and the ideas behind them, you will start to get your own ideas and your own potential strategies to test.įor instance, personally I am a big fan of Average True Range (ATR). started his working life as a mechanical engineer, and remained an engineer for just seven years. When reading the book, I would recommend to focus on the rough concepts and the “big picture” of the different strategies and indicators, rather than taking them too literally. We are obviously working in totally different conditions today, have access to more knowledge and better technology, but also facing tougher competition in more efficient markets. It was the time when people were writing prices down and drawing charts by hand. Welles Wilder describes them, we should keep in mind that the book was written in 1978 and mainly from the perspective of commodity futures markets, working with end of day data only. While it’s tempting to copy the strategies exactly as J. It often described the calculations and actions step by step, day by day as the market trades. To some readers it may feel a bit dense and a bit too mathematical (although all the mathematics is quite simple).Īnother thing you may notice is that unlike many other trading books, this one is very specific in terms of the presented trading strategies and exact settings. The text itself is not very long, but contains lots of ideas. When you first see the book, you will be surprised how short it is – only about 130 pages, many of them being various charts and tables with data. Get it on Amazon: New Concepts in Technical Trading Systems What to Take from the Book

#J welles wilder archive#

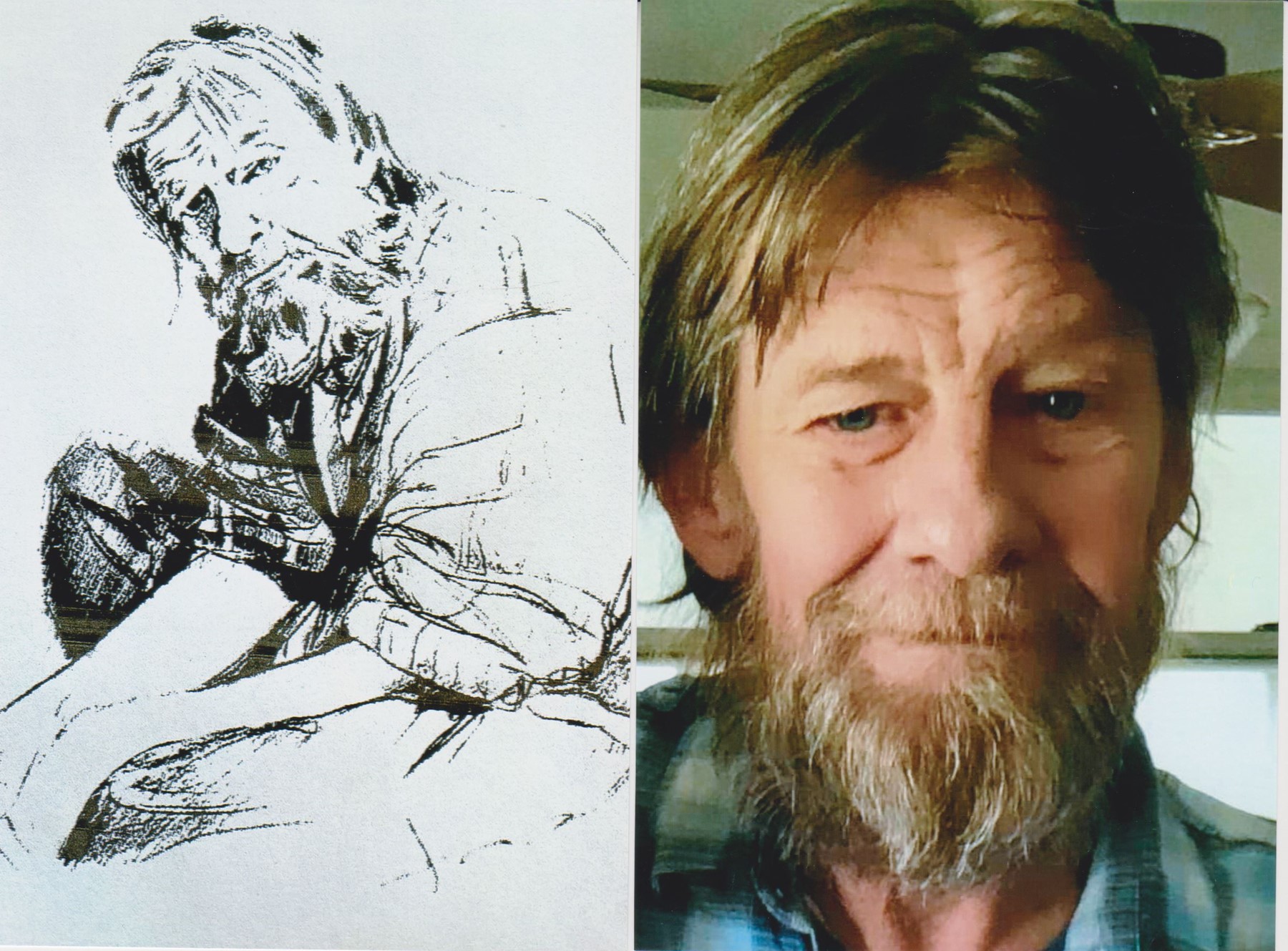

: Trend Research Collection inlibrary printdisabled internetarchivebooks china Digitizing sponsor Internet Archive Contributor Internet Archive Language English. Much of Wilder’s work was first presented to the world in this book. Publication date 1978 Topics Commodity exchanges, Speculation Publisher Greensboro, N.C. Welles Wilder Jr., invented numerous tools which are the classics of technical analysis, including indicators such as Relative Strength Index (RSI), Average True Range (ATR), Parabolic SAR, and Average Directional Index (ADX/DMI). S., Valavanis, Kimon, P., Surveying stock. This listing is for a vintage, hardcover copy of: New Concepts in Technical Trading Systems by J.

It was first published in 1978, but still remains among the bestsellers 40 years after without any updates. Welles Wilder, New Concepts in Technical Trading Systems, 1978. New Concepts in Technical Trading Systems is one of the most innovative books ever written on technical analysis and technical trading.

0 kommentar(er)

0 kommentar(er)